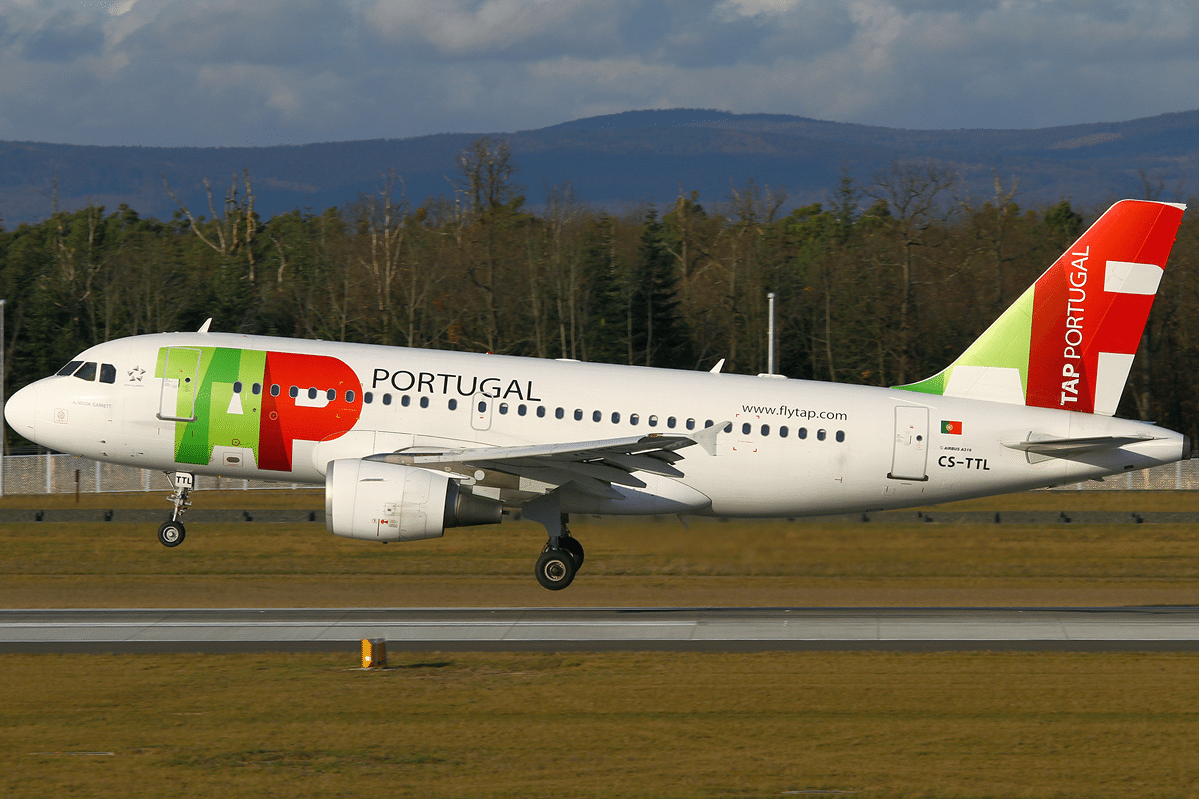

Air France-KLM may be interested in investing in Portuguese airline TAP SA as it seeks industry backers for the airline the Lisbon government had to bail out during the coronavirus crisis.

Chief Executive Ben Smith said Friday that the French and Dutch groups would “definitely formally” work together towards some sort of “partnership or ownership”.

“If the situation is right, there will be an interest,” Mr. Smith told Bloomberg his television. “Especially in Europe, integration is very important to us. We have been studying the Iberian Peninsula for many years. TAP was forced to merge with a “major airline group” to survive after suffering a €1.6 billion ($1.5 billion) net loss last year. The government has offered the airline €2.55 billion in aid. provided.

TAP’s main attraction for potential airline investors lies in its service to Brazil, with a previous sale in 2015 attracting little European interest, and its two companies in Latin America. led to the bidding of

Portugal eventually agreed to sell its 61% stake to a group led by Brazilian-American entrepreneur David Neeleman, founder of JetBlue Airways Corp. and Brazilian airline Azul. Then, after a left-leaning government regained a majority stake, Neeleman pulled out entirely amid the Covid pandemic.

Lufthansa, IAG

Deutsche Lufthansa AG, which owns former national airlines in Austria, Belgium and Switzerland, acquired TAP after winning Italian startup ITA Airways’ bid for one of the US-led groups. May become another stakeholder in a new sale of Lose Funds Certares Management and include Air France-KLM. Still, German airline CEO Carsten Spohr said on Oct. 14 that he had no interest in the property unless control was obtained and ITA did not meet that requirement. It is not clear how much of TAP Portugal’s shares will be sold.

TAP said earlier this year that new investors would put the company on a stronger footing as it moves forward with its restructuring plans. Nuno Santos said in March that “several parties” had expressed interest.

IAG SA, Europe’s third largest airline group and parent company of British Airways, is a potential TAP candidate as it also owns the Portuguese rival Spanish airline Iberia. is widely considered low.

IAG CEO Luis Gallego said separately on Friday that although the group remains interested in acquiring all of the Spanish leisure operator Air Europa from its current 20%, each transaction said it could take another year.

Turkish Airlines denied it was considering a stake in TAP last November after the Portuguese newspaper Jonal de Negocios reported that it was considering a stake in TAP.